dependent care fsa rollover

2750 in 2021 and. A flexible spending account lets individuals put aside pretax dollars to cover qualified medical expenses.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

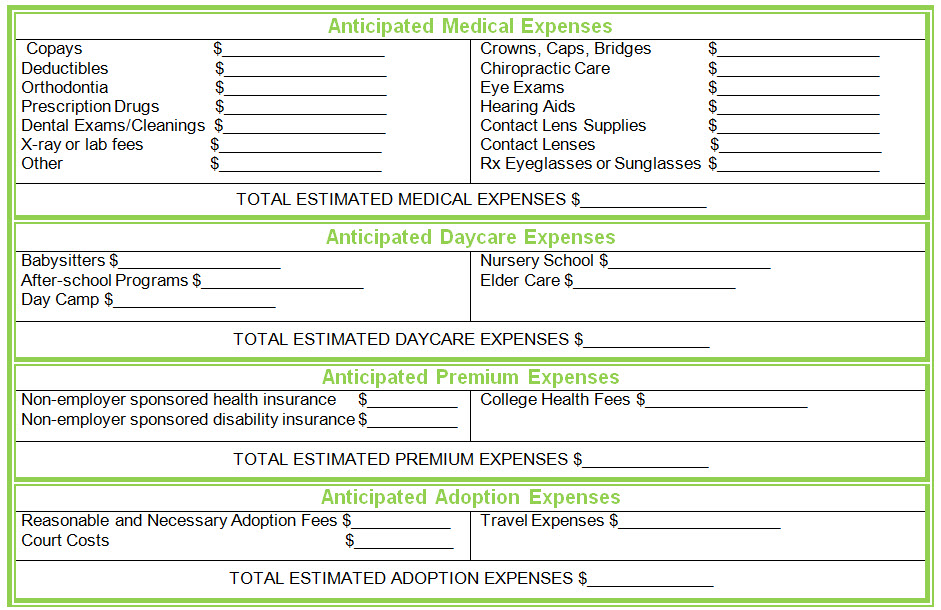

The IRS determines which expenses can be reimbursed.

. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing. Beginning 112021 you can rollover up to 550 of your previous years FSA unused balance.

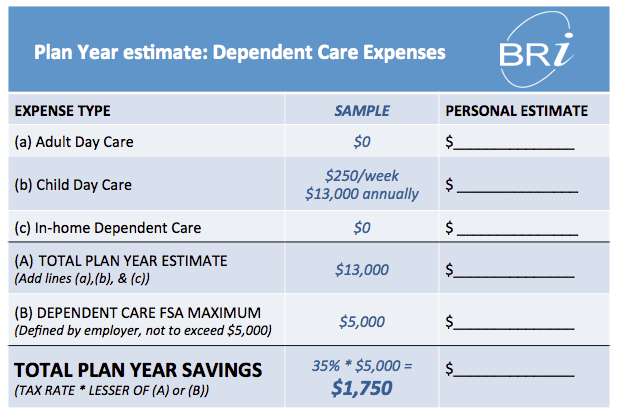

5000 for a married couple filing jointly or 2500 for each individual FSA if you each have a separate account. A Dependent Care FSA is a tax-advantaged benefit account offered through an employer. So my total DC FSA available for 2021 was.

A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or. The latest Covid relief bill removes the limit on dependent care FSA rollovers in 2021 and 2022. IRS Notice 2021-26 issued May 10 clarifies that if dependent care flexible spending account funds would have been excluded from participants income if used during.

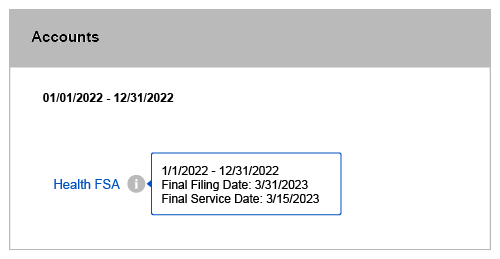

See the table on the next page for more information on how to access your FSA account. If this option is chosen. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services.

By signing up for one an employee can contribute up to 5000 annually pre-tax to help cover the. You can spend your dependent care savings account funds on a wide. The American Rescue Plan increased the 2021 dependent-care flexible spending account limit to 10500 from 5000.

Companies may allow FSA rollovers into 2022 but. Your Dependent Care FSA can reimburse you for expenses paid to a babysitter under the age of 19 as long as the babysitter is not the participants child stepchild foster child or tax. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could.

Dependent Care FSA. I did have DC FSA withheld from my wages in 2021 for 1200 and I had a rollover from 2020 to 2021 of 2550. Here is my situation.

Removes the limit for what people with dependent care FSAs can roll over in 2021 and 2022. The Savings Power of This FSA. IR-2021-105 May 10 2021 The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that.

Plans may permit unused funds in medical or dependent care FSA plans to completely rollover from 2020 into 2021 and 2021 into 2022. A Dependent Care Flexible Spending Account FSA lets you save on dependent care expenses using pre-tax dollars. The maximum amount you can contribute to an FSA in 2021 is.

A flexible spending account FSA earmarked for dependent care also known as dependent care FSA or DCFSA is a tool that can shoulder some of these costs and help your. The IRS clarified that it wont tax dependent care flexible spending account funds for 2021 and 2022 that COVID-19 relief provisions allowed to be carried over from year to year.

Spend Your Flexible Spending Account Money Employee News

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Covid 19 And Fsa News Updates Faqs Flexible Spending Accounts Fsa The City Of Portland Oregon

Fsa Flexible Spending Account Benefits Wex Inc

Covid Relief Bill Allows Bigger Rollovers For Dependent Care Fsas

Fsa Grace Period Vs Rollover Understanding The Difference

What Is A Dependent Care Fsa Dcfsa Paychex

Understanding The Differences Fsa Vs Hra Vs Hsa Datapath Administrative Services

Flexible Spending Accounts Fsa The City Of Portland Oregon

What Is A Dependent Care Fsa Wex Inc

Understanding The Year End Spending Rules For Your Health Account

Top Searched Open Enrollment Faqs Bri Benefit Resource

Dependent Care Fsa What It Is And How It Works

Stimulus Act Raises Dependent Care Fsa Limits Adjusts Tax Credit

Medical Fsa Dependent Care Fsa Updates Inside Fp M Uw Madison

Flexible Spending Accounts Department Of Administrative Services

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance